will capital gains tax increase be retroactive

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada. Would cut about 900 billion of the estimated 1 trillion that a capital gains tax increase could generate for the.

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Although Congress has the constitutional authority to make retroactive tax increases they have historically been the exception rather than the rule.

. Congress has historically never affected tax bills on a retroactive basis but these are uncertain times and congress is. Retroactive Tax Increase. With no tax law changes your client would expect capital gains tax.

Under the current proposal gains realized prior to sept. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021.

President Biden really is a class warrior. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1.

The test upholds retroactive tax. As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396.

The Administration leaked Thursday that. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge. A Multimillion-Dollar Sale No.

Pushing it to 2022 would create a mess Joe Biden campaigned on raising the capital gains tax rate to 396 from 200 on those earning more than 1 million. Bidens capital-gains tax plan may be retroactive worrying top bank CEOs. The Green Books proposed long-term capital gains increase would be the first retroactive capital gains increase in US.

The Green Book specifically provides for a retroactive effective date for the capital gains tax increase. This change has and could cause more disruption and volatility to the market as shareholders panic and quickly sell. The only major capital gains rate increase since 1980 was not made retroactive.

June 16 2021 1108 AM PDT. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Are retroactive tax increases constitutional or even fair. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 president biden. The proposed capital gains rate hike may be retroactive to the date of announcement the.

7 rows However this recent experience does not foreclose the possibility that a capital gain rate increase could be implemented on a retroactive basis. In fact of the five major tax rate increases since 1980 only one had a significant retroactive effective date. Will capital gains tax increase be retroactive.

History that may have far-reaching consequences. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

This has canada speculating again if a hike to the capital gains inclusion rate. June 1 2021 by News Desk. In some cases you add the 38 Obamacare.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. CNBC Television published this video item entitled Biden calls for his capital gains tax proposal to.

Thus the capital gains tax excluding the surtax for 2020 would be 800000 20 times 4 million. Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Tax Plan And 2020 Year End Planning Opportunities

Patrick Are Capital Gains Taxes Changing Local News Valdostadailytimes Com

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

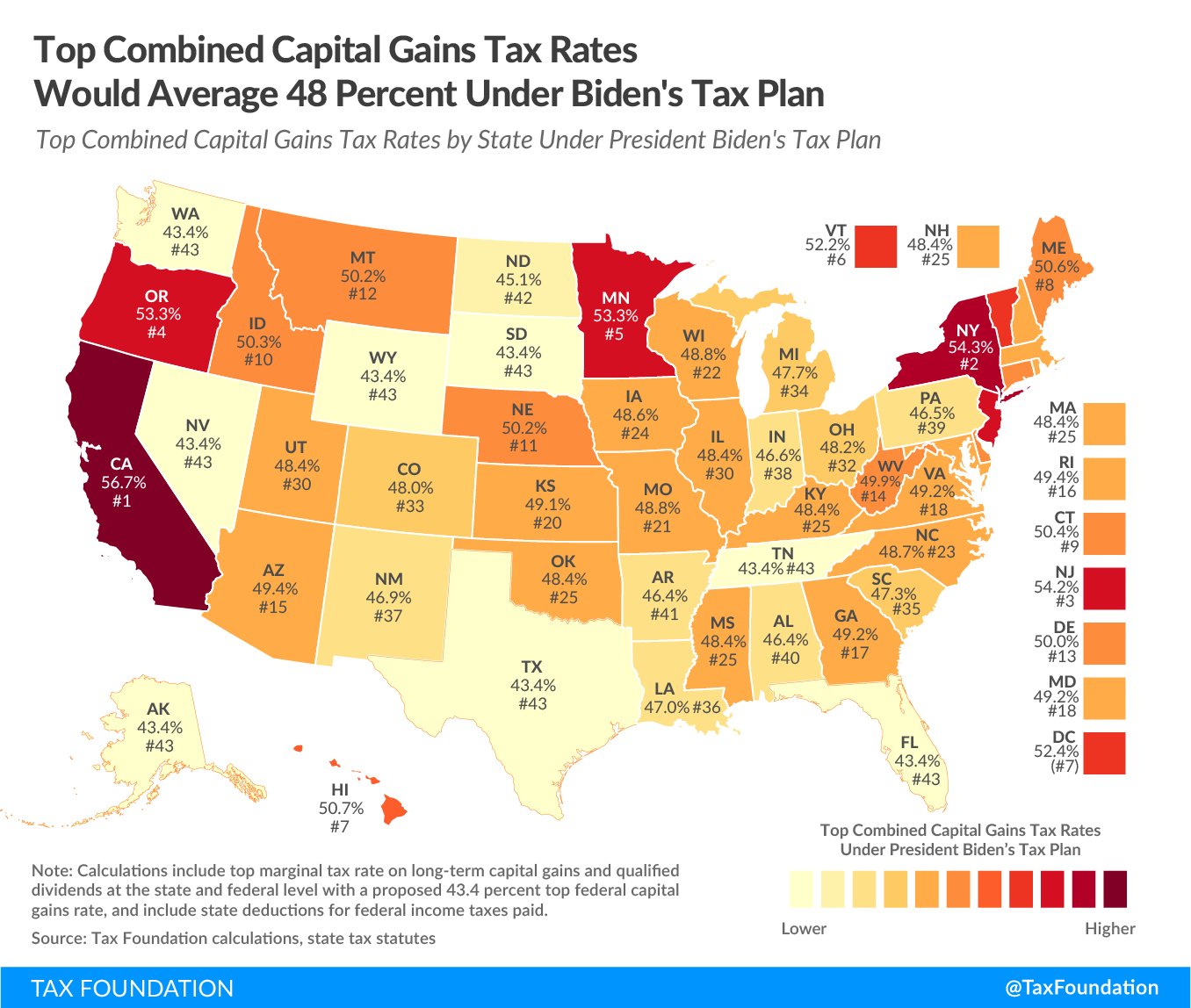

Tax Foundation On Twitter Under President Biden S Tax Plan 13 States And D C Would Have A Top Combined Capital Gains Tax Rate At Or Above 50 56 7 Ca 54 3 Ny 54 2 Nj

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Biden S Proposed Retroactive Capital Gains Tax Increase

Managing Tax Rate Uncertainty Russell Investments

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Medicaid Corporate Law Marketing Jobs

Good And Bad News From The Aba Futures Report Perspective Decade Century Aba Bad News

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra